WealthRabbit Support

Need Help? We've got you covered

How can I set up a Traditional IRA through WealthRabbit?

WealthRabbit provides simple, step-by-step instructions to help you set up your Traditional Individual IRA plan without any unnecessary complications or confusion. Follow these steps for a smooth and hassle-free experience:

Step 1: Sign in to your WealthRabbit account.

Step 2: Select the ‘I am an Individual’ option to set up an IRA for yourself.

Step 3: Choose the IRA plan that best suits your needs. WealthRabbit offers two IRA plans:

-

Traditional IRA: This option helps lower your taxable income now, and you’ll pay taxes later when you make withdrawals. It’s ideal if you expect to be in a lower tax bracket during retirement.

-

Roth IRA: This option requires you to pay taxes upfront, but allows tax-free withdrawals later. It’s suitable if you expect to be in a higher tax bracket in the future.

Here we select ‘Traditional IRA’.

Step 4: Complete the two-factor authentication process for security and proceed.

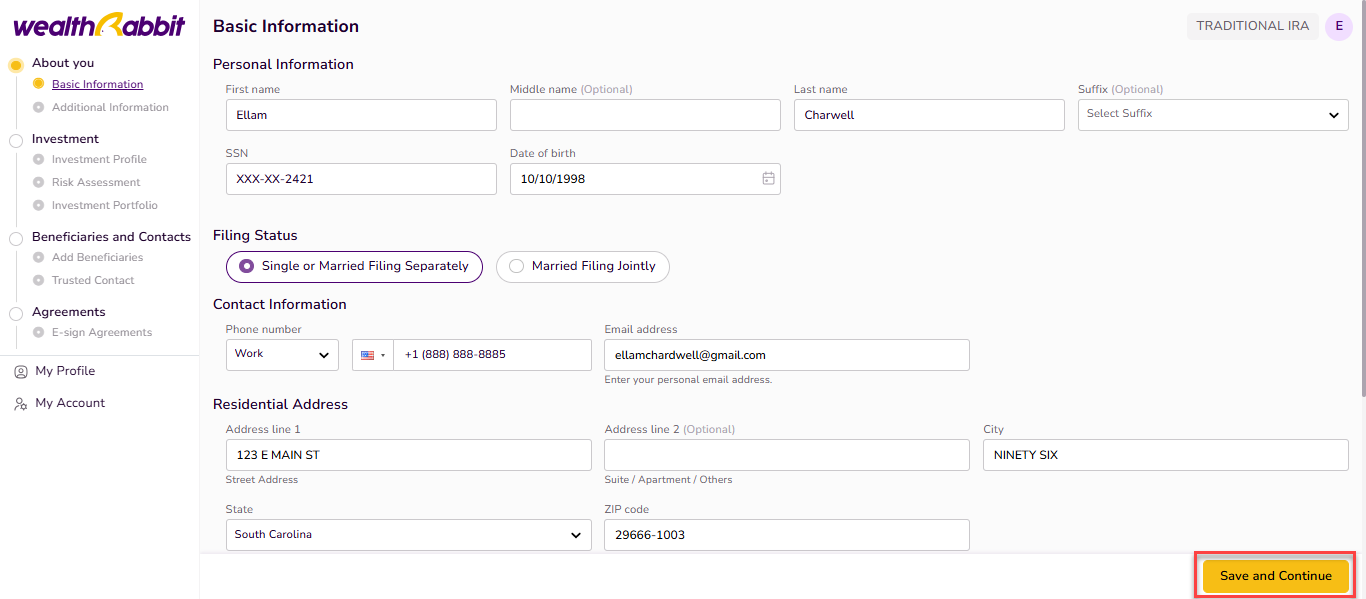

Step 5: Enter your basic personal information in the required fields, review the details carefully, and click ‘Save and Continue’.

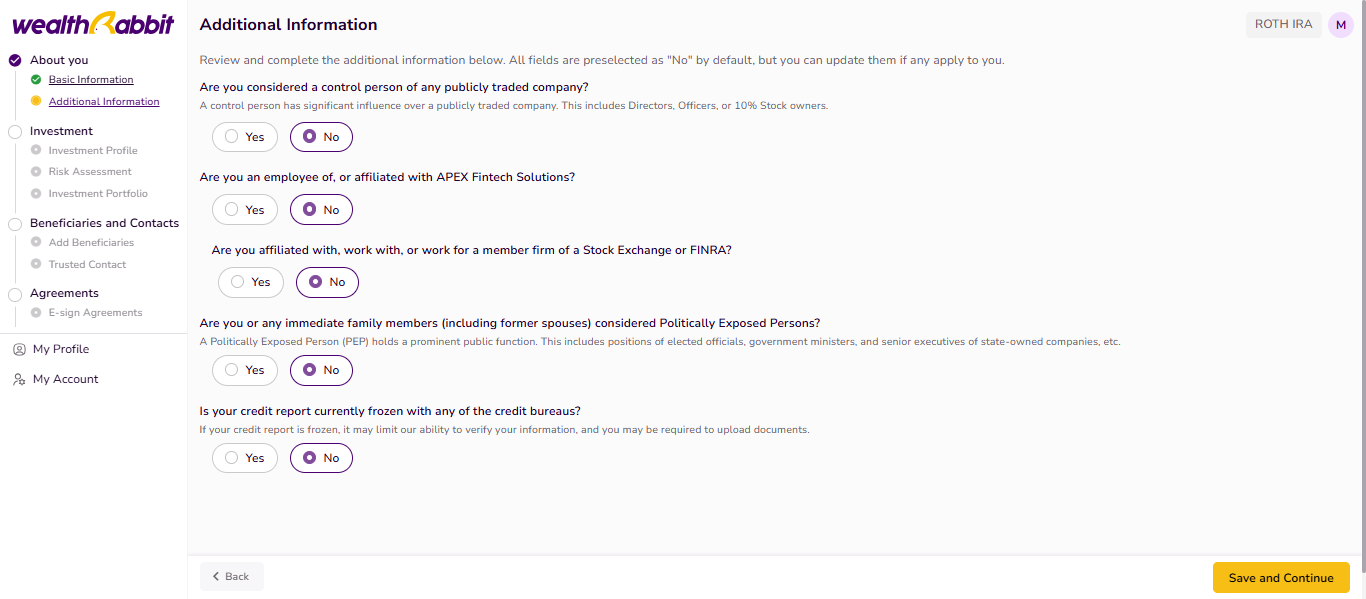

Step 6: Review and complete the additional personal information. All fields are set to “No” by default, but you can update them if applicable.

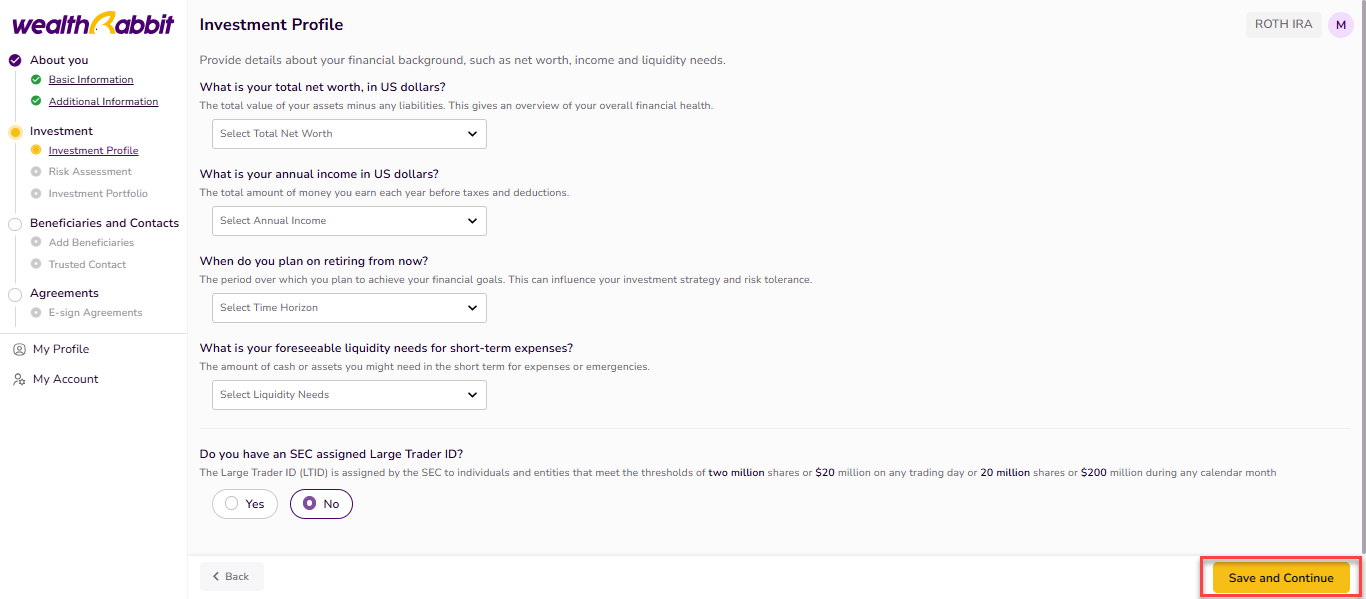

Step 7: Provide details about your financial background, such as net worth, income, and liquidity needs. Ensure all information is accurate and click ‘Save and Continue’.

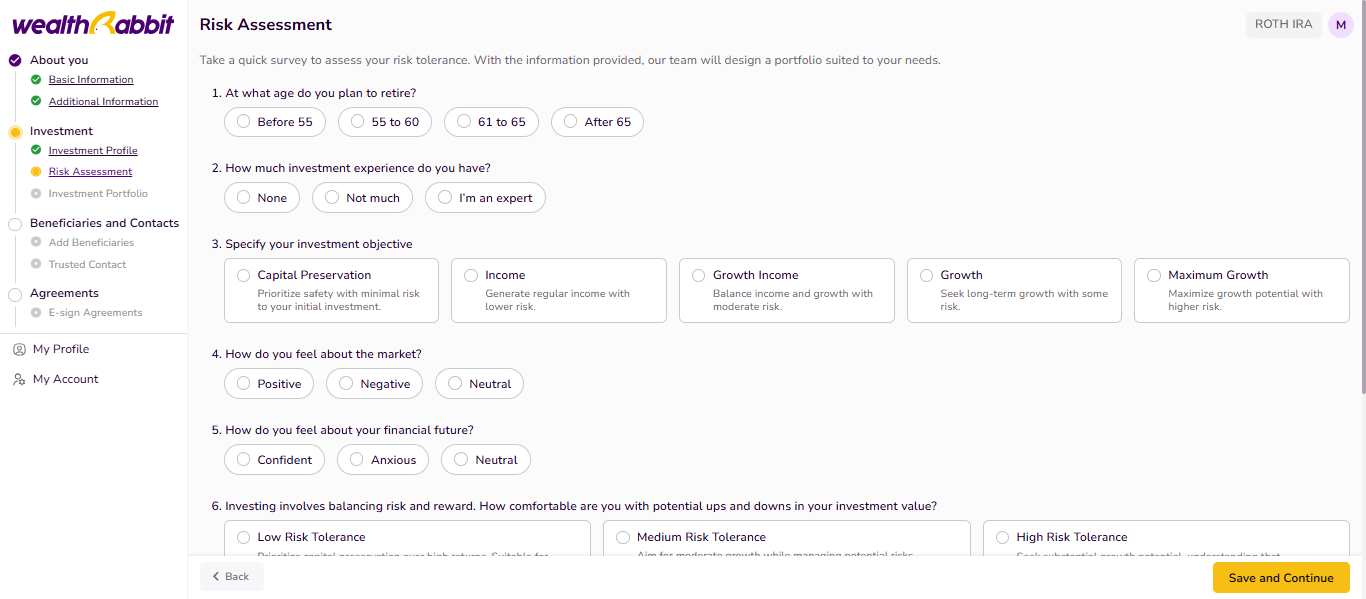

Step 8: Select the options that apply to your retirement plans. Take a short survey to assess your risk tolerance. Based on your responses, WealthRabbit will design an investment portfolio tailored to your needs.

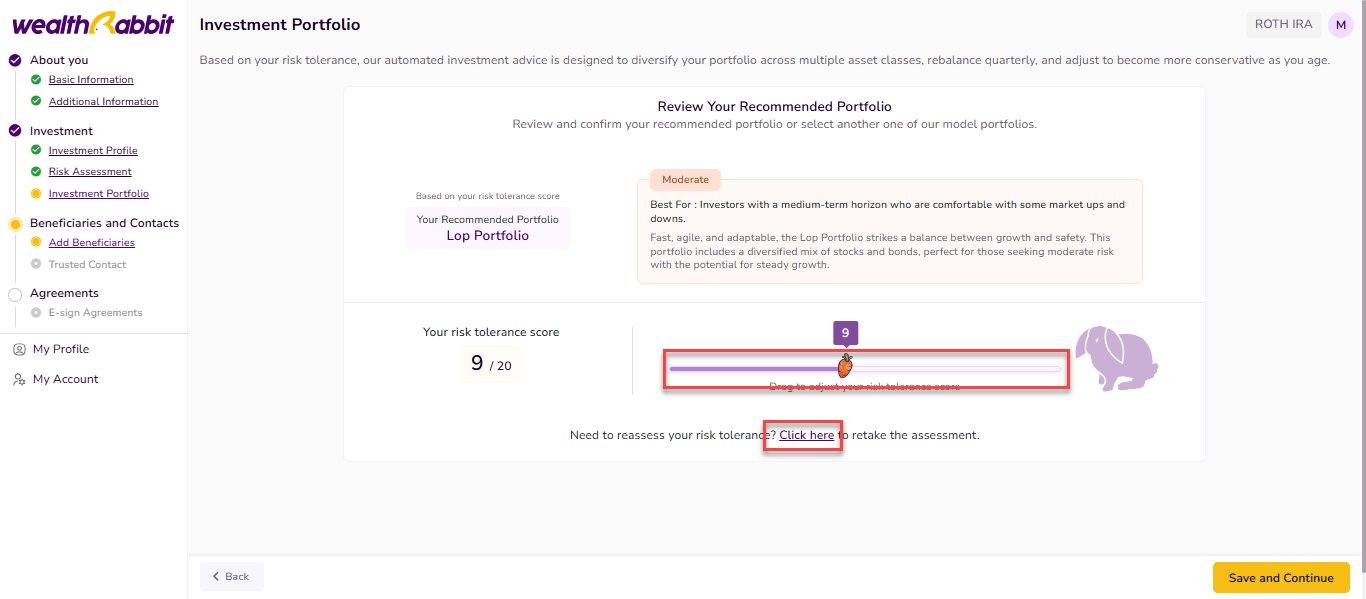

Step 9: According to your risk tolerance, our automated investment advice will diversify your portfolio across multiple asset classes, rebalance it quarterly, and adjust it to become more conservative as you age. Click here to learn more about risk tolerance scores and their benefits.

You can adjust the slider to choose another portfolio that suits your preferences. If you wish to reassess your risk tolerance, click the provided link to retake the survey.

Once you have reviewed and confirmed your recommended portfolio, click ‘Save and Continue’.

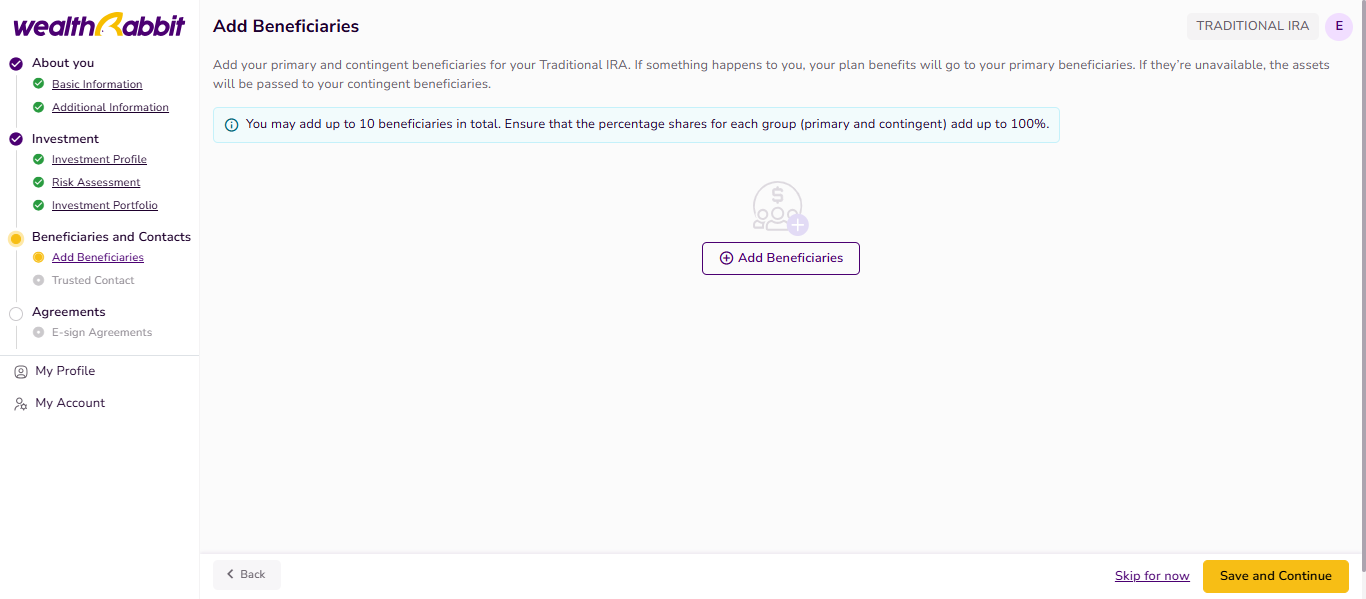

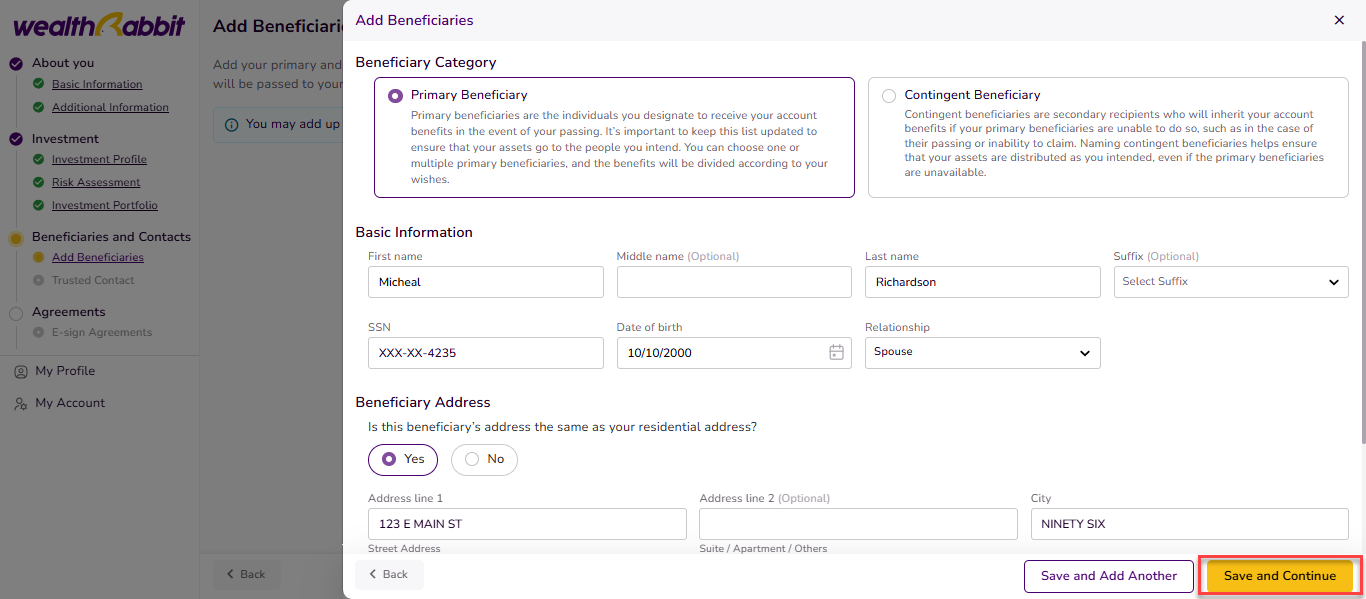

Step 10: Add your primary and contingent beneficiaries for the IRA plan. In the event of your absence, your plan benefits will go to your primary beneficiaries. If they are unavailable, the assets will be transferred to your contingent beneficiaries.

Step 11: Click ‘Add Beneficiaries’ to enter the details for your primary and contingent beneficiaries. Review the information, then click ‘Save and Continue’.

Click here to learn more about primary and contingent beneficiaries.

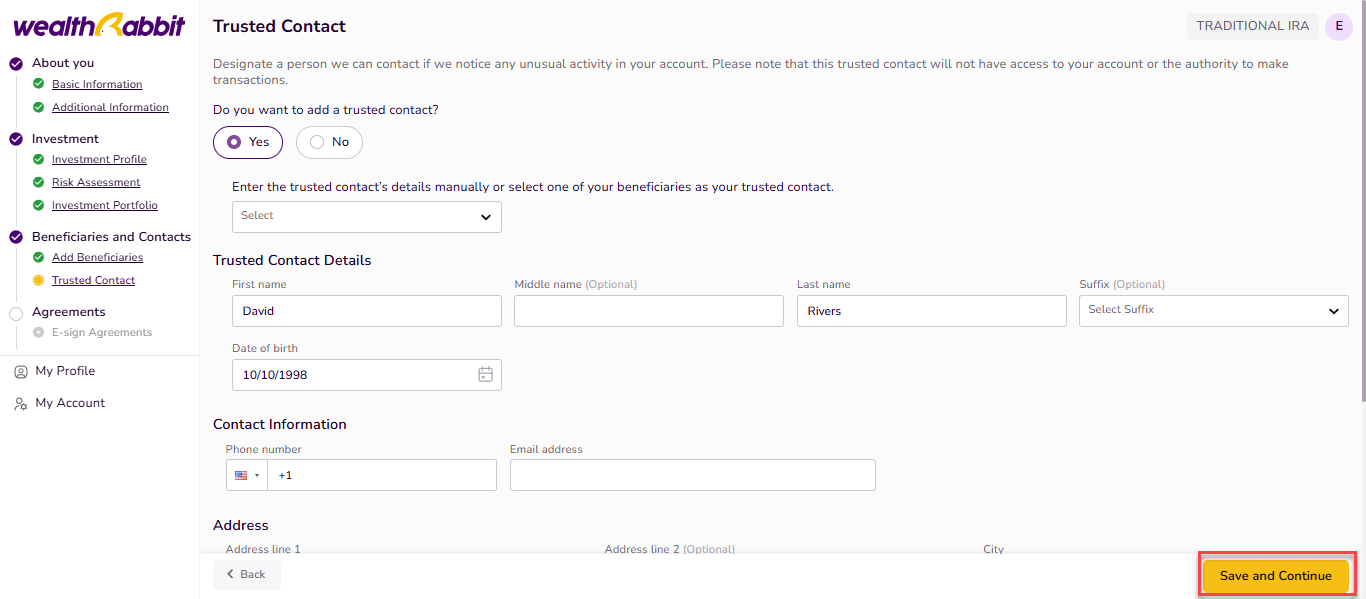

Step 12: Provide the contact details of a trusted person and click the ‘Save and Continue’ option.

Note: A trusted contact does not have access to your account or the authority to perform transactions.

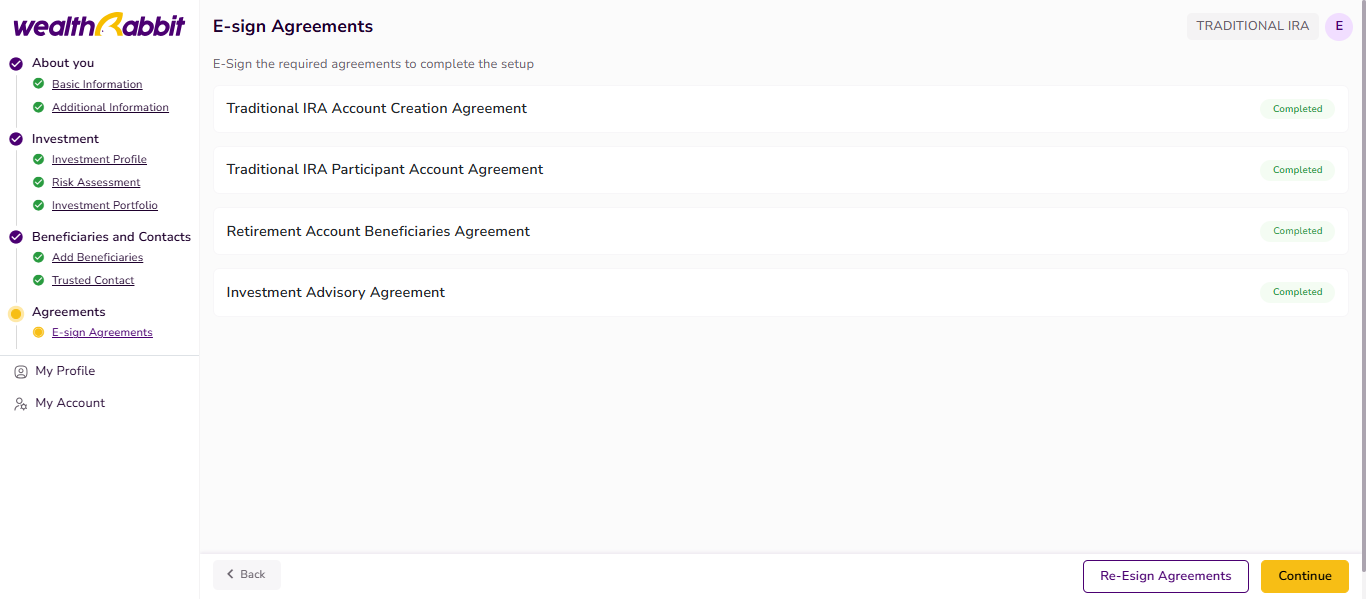

Step 13: E-sign the required agreement to complete your retirement plan setup.

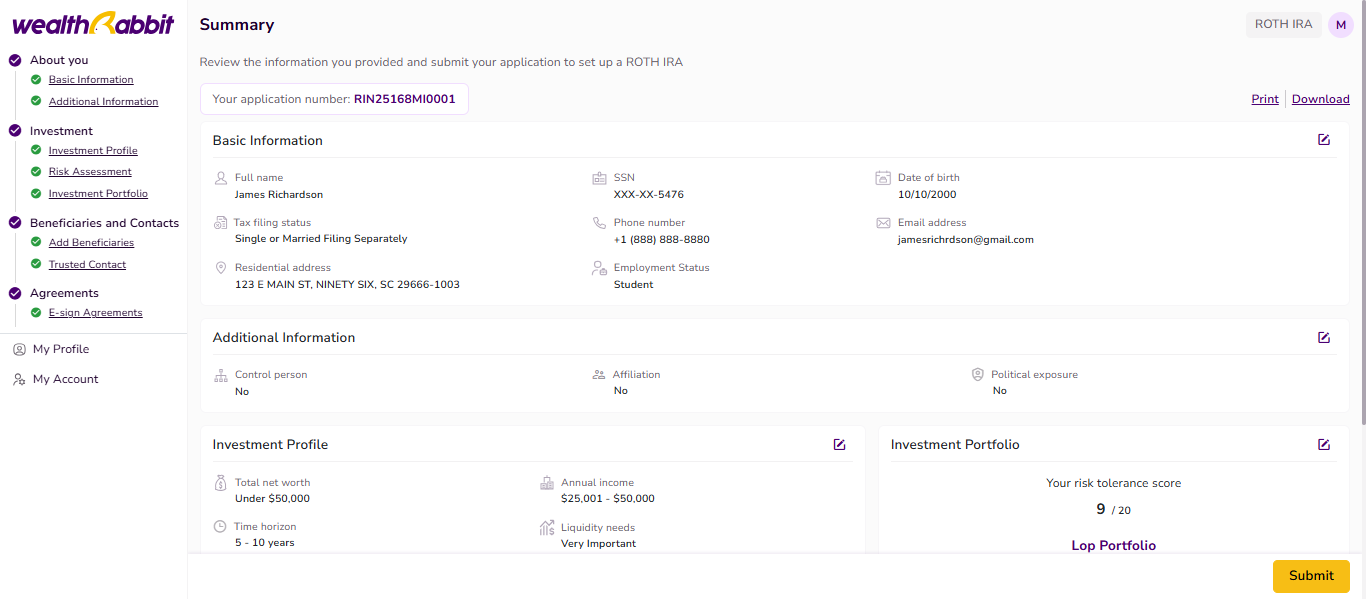

Step 14: Review all the information you’ve provided and submit your application to set up your Traditional IRA plan.

Need more help?

Get in touch with our dedicated support team Contact Us